2025 Social Security Wage Cap Increase

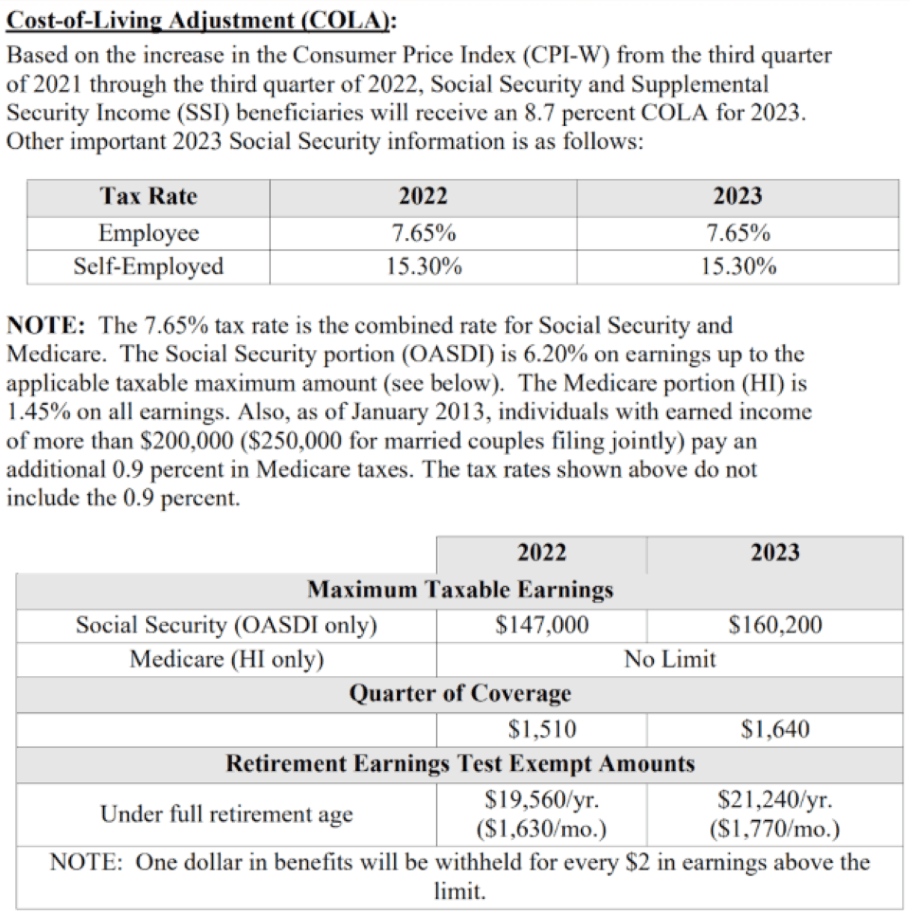

2025 Social Security Wage Cap Increase. The tax limit is indexed to inflation and is therefore estimated to rise in 2026. Social security caps the amount of income you pay taxes on and get credit for when benefits are calculated.

Additionally, social security benefits will increase for retirees. The social security wage base will increase to $176,100 in 2025, a $7,500 increase over the 2024 cap.

2025 Social Security Wage Cap Increase Images References :

Source: eloraasemercedes.pages.dev

Source: eloraasemercedes.pages.dev

Social Security Benefits 2025 Increase Chart Printable Darci Elonore, Each year, a wage cap is set to determine how much earnings are subject to social security taxes.

Social Security Increase For 2025 Projections Chart Eilis Harlene, The social security administration (ssa) announced on thursday, october 10, that the 2025 social security wage base will be $176,100, an increase of $7,500 from.

Source: libhjksabrina.pages.dev

Source: libhjksabrina.pages.dev

Social Security 2025 Limit Gwen Laverna, The amount needed to qualify for coverage will rise to $1,810 per quarter in.

Social Security 2025 Earnings Limit Sadie Sherilyn, Additionally, social security benefits will increase for retirees.

Source: easterhjklauree.pages.dev

Source: easterhjklauree.pages.dev

Social Security 2025 Tax Limit 2025 Ilyssa, The social security administration has revealed that the wage base for calculating social security tax will rise to $176,100 in 2025 (up from $168,600 in 2024).

Source: julivernaline.pages.dev

Source: julivernaline.pages.dev

Social Security 2025 Earnings Limit Sadie Sherilyn, For 2025, the ssa has set the cola at 2.5%.

Source: erinvolympie.pages.dev

Source: erinvolympie.pages.dev

Social Security 2025 Cola Letter Hailee Sharon, The amount needed to qualify for coverage will rise to $1,810 per quarter in.

Source: fifihjkbenedicta.pages.dev

Source: fifihjkbenedicta.pages.dev

Social Security 2025 Max Charla Jsandye, Social security wage base 2025 increase.

Source: libhjksabrina.pages.dev

Source: libhjksabrina.pages.dev

Social Security 2025 Limit Gwen Laverna, Also in 2025, the wage cap for social security taxes will increase.

Source: julivernaline.pages.dev

Source: julivernaline.pages.dev

Social Security 2025 Earnings Limit Sadie Sherilyn, Thus, an individual with wages equal to or larger than $176,100 would.

Posted in 2025